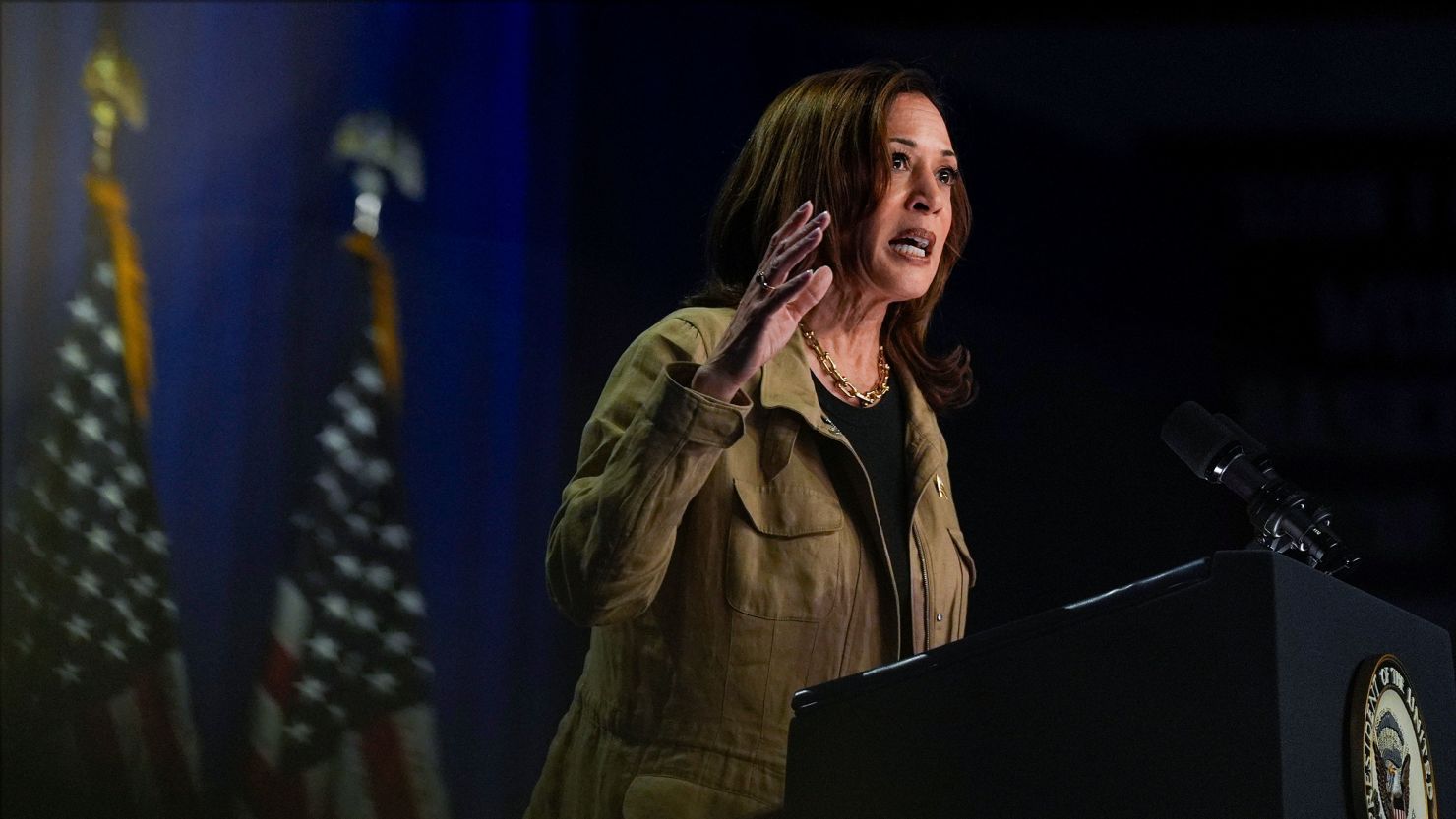

A tax proposal embraced by Vice President Kamala Harris that’s meant to target the wealthy is getting attention in an unlikely place for wonky policy debate: social media.

A tax proposal embraced by Vice President Kamala Harris that’s meant to target the wealthy is getting attention in an unlikely place for wonky policy debate: social media.

Source: What Harris’ unrealized capital gains tax proposal means for you | CNN Politics

I wrote⬇️while reading⬆️:

could the law that imlpents this tax include a sun-down condition, like once some metric is hit, the tax is removed, or is calculatedf such that it rewards good investing instead of hoard or parking or off-shorining investing (is this called caqpital flight?).

like in the law it says no chaning this law. but what stops a new law from overridgeing an old law?

the threat of caital flight from the usa seeems overblown, since where else in the world would you liek to invest? or am i wrong that usa is probably still the safest bet?

article mentions the idfficulty of determining asset value increases per year, not enough staff resources, but why not make it part of your reporting of the assest? cheating handled by threat of aiudits

i akised gemini fto clean it up:

This is a really interesting set of questions about tax law and capital flight! Let me try to clean this up and address your points:

1. Sunset Provision and Rewarding “Good” Investing:

It’s definitely possible for a tax law to include a “sunset provision” – a clause that automatically ends the tax after a certain condition is met (like a specific date, or when a certain revenue target is reached).

As for rewarding “good” investing, that’s where things get trickier. Defining what constitutes “good” is subjective and can be difficult to legislate. However, tax laws often include incentives to encourage certain behaviors, such as:

- Tax deductions or credits for investments in specific sectors: This could include things like renewable energy, affordable housing, or research and development.

- Lower tax rates on long-term capital gains: This encourages investors to hold assets for longer periods, promoting stability.

These types of incentives could discourage practices like “hoarding” (holding assets without productive use), “parking” (holding assets in low-tax jurisdictions), and “offshoring” (moving investments out of the country, also known as capital flight).

2. Changing or Overriding Existing Laws:

You’re right, a law can’t explicitly prevent future laws from modifying or repealing it. While lawmakers might try to signal their intent for a law to be permanent, any legislative body generally has the power to amend or overturn existing legislation. This is a core principle of how legal systems evolve.

3. Capital Flight Concerns:

Whether the threat of capital flight from the USA is overblown is debatable. While the US remains a dominant and relatively safe investment destination, factors like:

- Tax rates: Higher taxes could potentially make other countries more attractive to investors.

- Political and economic stability: Uncertainty or instability in the US could cause some investors to seek safer havens.

- Regulatory environment: Changes in regulations could impact investment decisions.

It’s also worth noting that investors consider many factors beyond just safety, including potential returns, diversification, and access to specific markets.

4. Asset Valuation and Audits:

You’ve hit on a key challenge with wealth taxes – accurately valuing assets. Requiring taxpayers to report asset values as part of their tax filings is a common approach. Combining this with:

- Random audits: This helps ensure compliance and deters cheating.

- Leveraging technology: AI and machine learning could potentially assist in identifying discrepancies or high-risk cases for audit.

could help address the resource constraints of tax authorities.

I hope this helps clarify your questions! It’s a complex topic with lots of nuances.